In a recent initiative aimed at enhancing tax compliance, the Bureau of Internal Revenue (BIR) launched a Tax Compliance Verification Drive (TCVD) from February 10 to February 14, 2025. This campaign has revealed significant issues, including thousands of unregistered businesses and widespread bookkeeping deficiencies across various sectors.

Key Takeaways

- The TCVD is part of the BIR’s Tax Awareness Month campaign.

- Over 24,000 establishments were inspected on the first day.

- The drive aims to educate businesses about their tax obligations without imposing penalties.

- Common violations include lack of registration, missing invoices, and improper bookkeeping.

Overview of the Tax Compliance Verification Drive

The BIR’s TCVD is designed to educate businesses about their tax responsibilities while identifying common compliance issues. Commissioner Romeo Lumagui Jr. emphasized that the primary goal of this initiative is to foster understanding rather than impose penalties. The drive is part of a broader effort to improve tax compliance and awareness among business owners.

Findings from the Drive

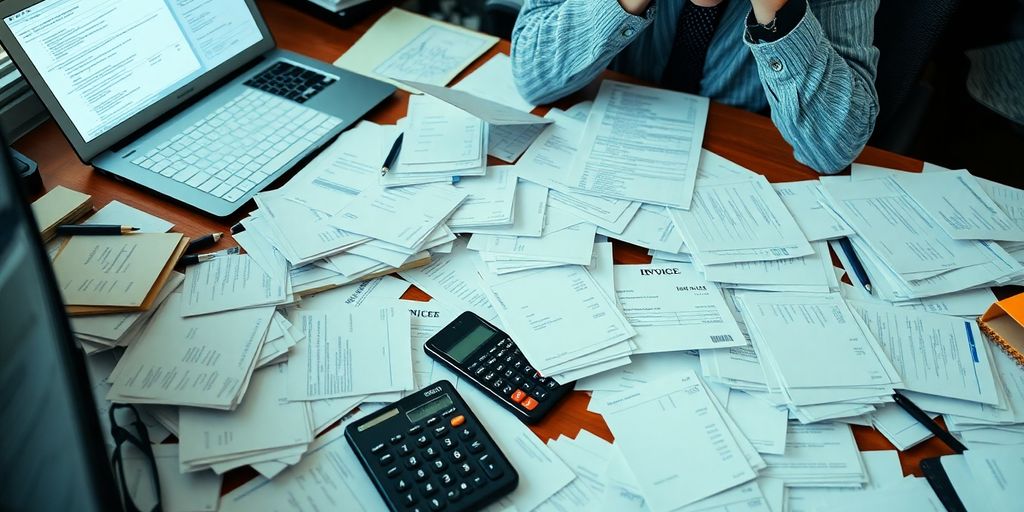

During the first day of inspections, the BIR uncovered alarming statistics:

- Unregistered Businesses: Many establishments were found operating without proper registration with the BIR.

- Missing Invoices: A significant number of businesses failed to maintain proper invoices, which are crucial for tax reporting.

- Bookkeeping Issues: Numerous businesses did not keep adequate books of accounts at their places of operation.

These findings highlight the need for better bookkeeping practices and adherence to tax regulations among businesses.

Educational Focus of the TCVD

The BIR is taking a friendly approach during the TCVD, focusing on education rather than punishment. Lumagui stated, "We are here to educate our taxpayers, not penalize. Education leads to compliance. Improved services lead to compliance." This approach encourages businesses to engage with BIR officials, ask questions, and seek clarifications about their tax obligations.

Types of Businesses Inspected

The TCVD covers a wide range of business sectors, including:

- Retail Stores

- Restaurants

- Healthcare Providers

- Automotive Shops

- Construction Supply Stores

This diverse coverage ensures that various industries are included in the educational outreach, promoting a comprehensive understanding of tax compliance.

Conclusion

The BIR’s Tax Compliance Verification Drive serves as a crucial step towards improving tax compliance in the Philippines. By focusing on education and awareness, the BIR aims to address the significant challenges faced by businesses in maintaining proper bookkeeping and registration. As the drive continues, it is expected that more businesses will recognize the importance of adhering to tax regulations, ultimately leading to a more compliant and transparent business environment.