Ever thought about creating your own personal financial statement template in Excel for 2025? It’s not as hard as it sounds, and it can really help you get a grip on your finances. Whether you’re planning for the future, trying to impress a banker, or just want to keep your money matters in check, having a personal financial statement template in Excel can be a game-changer. Let’s dive into why you need one, how to set it up, and some common pitfalls to avoid.

Key Takeaways

- A personal financial statement template in Excel is a handy tool for managing and understanding your financial health.

- Setting up your template in Excel can be simple and customizable to fit your needs.

- Avoid common mistakes like overcomplicating your template or forgetting to back up your data.

Why You Need a Personal Financial Statement Template

Understanding Your Financial Health

Alright, let’s talk about why having a personal financial statement template is like having a magic mirror for your money. You know how you sometimes peek in the mirror to see if you still look good? Well, your financial statement does the same for your finances. It shows you where your money is, where it’s going, and how it’s behaving. Think of it as a health check-up, but for your wallet. You get to see your assets, liabilities, and net worth all in one place. It’s like having a personal money diary that doesn’t judge you for that impulse purchase.

Planning for the Future

Ever tried planning a road trip without a map? Total chaos, right? A financial statement is your map to the future. It helps you set financial goals and shows you how close or far you are from them. Want to buy a house, travel the world, or just make sure you have enough for a rainy day? Your financial statement is your trusty guide. Plus, it makes you feel like a financial wizard when you see your savings grow.

Impressing the Bankers

Picture this: you walk into a bank, and instead of sweating bullets, you’re cool as a cucumber. Why? Because you’ve got your financial statement ready to roll. Bankers love it when you come prepared. Whether you’re applying for a loan or just trying to get a better interest rate, having a detailed financial statement can make you look like the most responsible adult in the room. It’s like showing up to a meeting with all the right paperwork and a secret weapon in your back pocket.

Keeping Your Finances in Check

Let’s be real, keeping track of your finances can be as fun as watching paint dry. But with a personal financial statement, it’s a breeze. You can easily spot where you’re overspending, where you can cut back, and how to balance everything out. It’s like having a financial coach who doesn’t yell at you. Plus, it helps you efficiently manage bank statement downloads and keep everything organized. So, no more rummaging through piles of receipts or late-night panic attacks about where your money went.

Setting Up Your Excel Template Like a Pro

Alright, first things first. You gotta pick the right Excel version. It’s like choosing between a classic rock playlist or some modern pop hits. If you’re working on an older computer or just love the nostalgia, maybe stick with Excel 2013 or 2016. But if you’re all about the latest and greatest, go for Excel 365. Why? The newer versions have more features, better automation, and, let’s be real, they look cooler. Plus, you can take your template online and collaborate with others, which is super handy if you’re not the only one checking the numbers.

Here’s where you can let your inner designer shine! Personalizing your template is a piece of cake. Change the colors, fonts, and layout to match your vibe. Want a minimalist look? Go for it. Prefer something that screams "I love spreadsheets"? That’s cool too. Just remember, while you’re having fun, keep it functional. You don’t want to end up with a template that looks like a unicorn threw up on it.

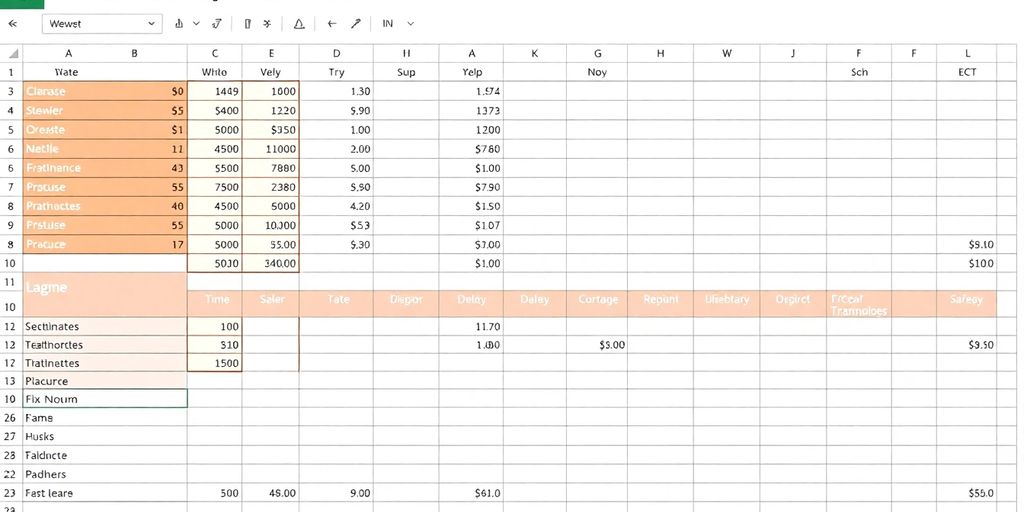

Now, let’s get to the meat of it. You need the right categories to make your financial statement actually useful. Think of it as setting up a playlist. You need your income, expenses, assets, and liabilities. Maybe throw in a "just in case" savings category. Pro tip: Don’t forget to add a column for notes. Sometimes, a simple "why did I buy so many avocados?" can save you a lot of head-scratching later.

Automation is your best friend here. Set up formulas to do the heavy lifting. Sum up your expenses, calculate your net worth, and let Excel handle the math. It’s like having a personal assistant who never complains. And if you’re new to this, check out some essential Excel tutorials to get started. Trust me, once you get the hang of it, you’ll wonder how you ever lived without these nifty tricks.

"The beauty of Excel is not just in its ability to organize your finances, but in its power to do the thinking for you. Set it up right, and it’s like having a financial wizard at your fingertips."

Common Mistakes and How to Avoid Them

Overcomplicating the Template

Alright, let’s talk about one of the most common pitfalls when setting up your personal financial statement in Excel: overcomplicating things. It’s easy to go down a rabbit hole of adding fancy formulas, charts, and colors. But remember, simplicity is key. You want a template that’s easy to update and understand, not a labyrinth of confusion. Stick to the basics and only add elements that truly enhance your understanding of your financial situation.

Ignoring Regular Updates

Your financial template isn’t a set-it-and-forget-it kind of deal. If you don’t update it regularly, it’s like using an old map to navigate a new city—totally useless. Set a reminder to update your financial details monthly. This way, you can keep track of your spending habits and adjust your budget accordingly.

Forgetting to Back Up Your Data

Imagine pouring your heart and soul into your financial template, only for your computer to crash and lose everything. Nightmare, right? Always back up your data. Whether it’s on the cloud or an external hard drive, make sure your hard work is safe. Trust me, you’ll thank yourself later.

Not Using Excel's Built-in Features

Excel is packed with features that can make your life easier, but many folks don’t take advantage of them. From pivot tables to conditional formatting, these tools can help you analyze your data more effectively. Spend a little time exploring these features—you might just find a new favorite tool that saves you time and headaches.

"Keeping your financial data organized and up-to-date is like maintaining a healthy diet. It might seem tedious, but the benefits are worth it."

Make sure to avoid these mistakes, and you’ll be on your way to creating a financial statement that’s not only functional but also a joy to use. And remember, if you’re juggling personal and business finances, consider using a bookkeeping checklist PDF to keep everything in order. Happy budgeting!

Making the Most of Your Financial Statement

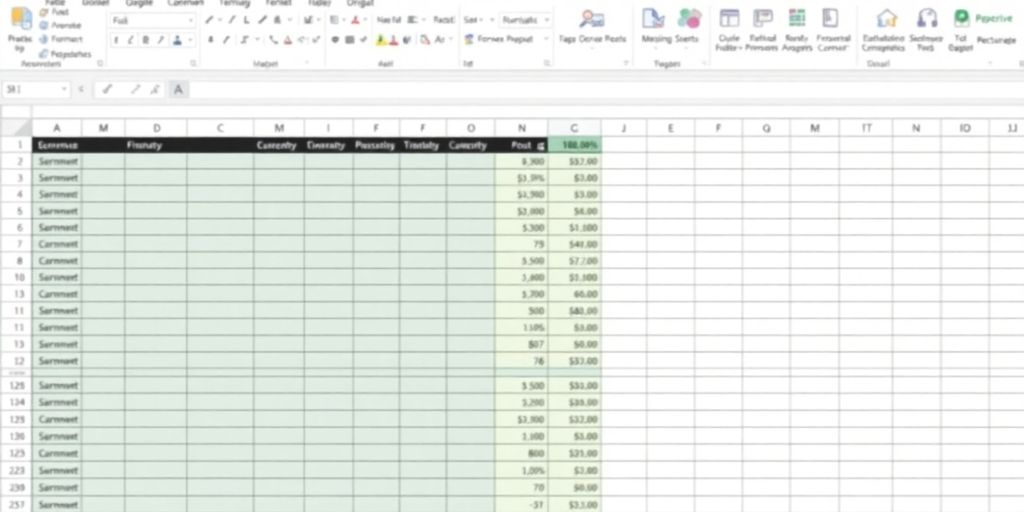

So, you’ve got your personal financial statement all set up in Excel. Now what? Well, it’s time to dive into the numbers and see what stories they tell. This isn’t just about crunching numbers; it’s about spotting trends. Are your savings growing or shrinking? Is your debt creeping up? By regularly reviewing your statement, you can catch these trends early and adjust your financial habits accordingly. Think of it as your financial crystal ball.

Setting Realistic Financial Goals

Once you’ve got a handle on your financial trends, it’s time to set some goals—but not just any goals. Make them realistic. It’s tempting to aim for the stars, but starting with achievable targets can keep you motivated. Maybe it’s saving a certain amount each month or paying off a credit card balance by the end of the year. Whatever it is, make sure it aligns with your financial reality and aspirations.

Sharing with Financial Advisors

Your financial statement isn’t just for your eyes only. Sharing it with a financial advisor can be a game-changer. These pros can offer insights you might not have considered and help you strategize for the future. They can also help you navigate any financial jargon and ensure you’re on the right path. Plus, having a second pair of eyes can never hurt.

Using for Loan Applications

Thinking about applying for a loan? Your personal financial statement can be your best friend in this scenario. Lenders want to see a clear picture of your financial health, and this document does just that. It shows them your assets, liabilities, and net worth, making the loan application process smoother. It’s like having your financial ducks in a row, ready to impress the bankers.

"Your financial statement is more than just numbers on a page. It’s a snapshot of your financial health and a tool to help you plan for the future. Use it wisely, and it can open doors to new opportunities."

Wrapping It Up: Your Financial Blueprint Awaits!

So, there you have it, folks! Crafting your own personal financial statement in Excel isn’t just a task—it’s a journey to understanding your money better. Sure, it might seem like a lot of numbers and cells at first, but once you get the hang of it, you’ll wonder how you ever managed without it. Whether you’re planning for a big purchase, trying to save a little extra, or just want to know where all your hard-earned cash is going, this template is your new best friend. Plus, with Excel’s nifty features, you can tweak and adjust to your heart’s content. So go ahead, give it a whirl, and take control of your financial future. Who knew spreadsheets could be so empowering? Happy budgeting!

Frequently Asked Questions

What is a personal financial statement?

A personal financial statement is a document that outlines your financial position at a specific point in time. It includes your assets, liabilities, and net worth.

Why should I use Excel for my financial statement?

Excel is a versatile tool that allows you to customize your financial statement template easily. It also offers features like formulas and charts to help you analyze your financial data.

Can I use this Excel template with other software?

Yes, you can use Excel templates with other spreadsheet software like Google Sheets or LibreOffice. However, some features may not work exactly the same.