Picture this: It’s tax season, your inbox is overflowing, and your star accountant just handed in their two weeks’ notice. Sound familiar? You’re not alone. The accounting world is facing a talent shortage that’s got CFOs sweating more than a CPA during an IRS audit.But fear not, fellow number enthusiasts! We’ve got the inside scoop on how to navigate this financial talent desert and come out on top. Grab your calculator and let’s dive in.

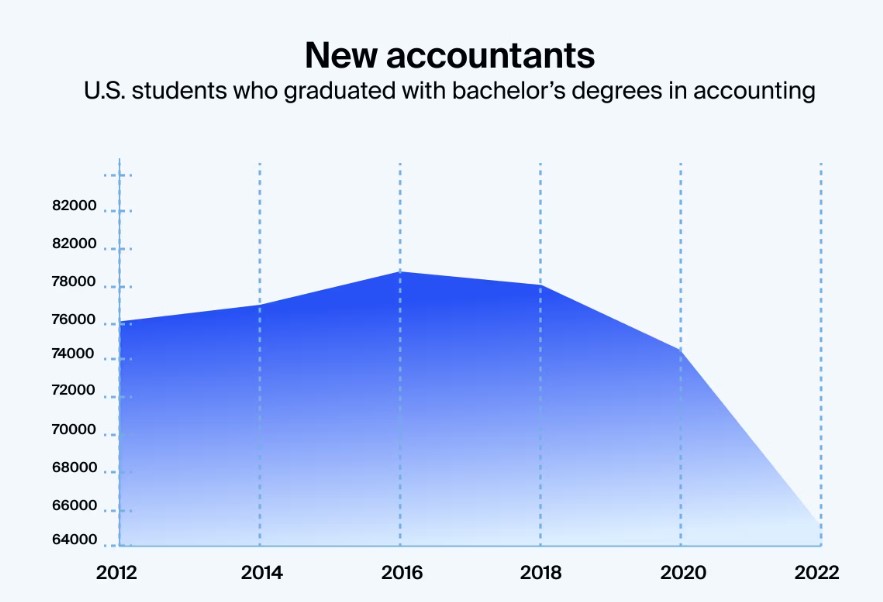

The Talent Drought: By the Numbers

Before we start doling out advice like it’s free tax prep, let’s crunch some numbers (because that’s what we do best, right?):

- The U.S. Bureau of Labor Statistics reports a staggering 17% decline in accountants and auditors between 2020 and 20221.

- A 2024 ICAEW report found that 52% of firms cited talent shortages as a major concern, with 70% listing talent-related issues as their top worry4.

- The AICPA predicts ongoing challenges in talent acquisition and retention until at least 20243.

Yikes. If those stats were on a balance sheet, we’d be calling for an emergency audit.

Why Are Accountants Jumping Ship?

So, what’s causing this mass exodus? It’s not just about the numbers (ironically). Here’s the tea:

- Stagnant Wages: Young accountants are watching their peers in finance and tech rake in the dough while their salaries flatline4.

- Burnout City: Long hours + high stress = accountants saying “see ya” faster than you can say “depreciation”4.

- Skill Gap Struggles: Traditional education isn’t keeping up with the tech-savvy demands of modern accounting4.

- Work-Life What?: The new generation wants more than just a paycheck. They’re after that elusive work-life balance1.

As Ricardo Buenrostro, a UC Davis finance guru, puts it: “The younger generation seeks more work-life balance, indicating a shift in expectations”3. Translation: It’s not just about the Benjamins anymore.

Recruiting Rockstar Accountants: The 2024 Playbook

Alright, enough doom and gloom. Let’s talk solutions. Here’s how to attract top talent faster than a tax refund hits your bank account:

1. Show Them the Money (But Not Just the Money)

Competitive salaries are a must, but don’t stop there. Get creative with your perks:

- Offer equity or profit-sharing to give them skin in the game.

- Implement a “work from anywhere” policy (because spreadsheets look better from a beach in Bali).

- Provide a “continuous learning” stipend for courses, conferences, or even quirky hobbies. Who knows? Maybe your next accounting whiz is also a part-time magician.

2. Tech It Up a Notch

Accountants in 2024 want more than just a calculator and a dream. They’re after cutting-edge tech:

- Invest in AI and automation tools to handle the grunt work.

- Offer training in data analytics and blockchain (because crypto isn’t going anywhere, folks).

- Create a “tech sandbox” where they can experiment with new software and tools.

As Ryu, CFO of RGP, notes: “43% of financial decision-makers are increasing investments in automated accounting processes and AI tools”3. Don’t get left behind in the abacus age.

3. Culture Club

Build a culture that’s more attractive than a perfectly balanced ledger:

- Implement mentorship programs to foster growth and connection.

- Host “Failure Fridays” where team members share lessons learned from mistakes (because even accountants aren’t perfect).

- Create a “Passion Project” initiative where employees can work on innovative ideas during paid time.

4. The Talent Pipeline: Start ‘Em Young

Why wait for talent when you can grow your own?

- Partner with universities to offer internships and co-op programs.

- Create a “Future CPAs” scholarship for promising high school students.

- Host “Accounting Hackathons” to spot talent early and make number-crunching cool again.

Retention: Keeping Your Accounting Aces

Congrats! You’ve landed some top talent. Now, how do you keep them from becoming another statistic? Here’s the retention rundown:

1. Career Cartography

Map out clear career paths that are more exciting than a perfectly executed pivot table:

- Offer rotational programs to expose them to different areas of finance.

- Create “stretch assignments” that push their skills and keep them engaged.

- Implement a “Choose Your Own Adventure” career track where they can customize their path.

2. Work-Life Wizardry

Help your team achieve that mythical work-life balance:

- Introduce “No Meeting Wednesdays” for deep work and personal projects.

- Offer sabbaticals for long-term employees (imagine coming back refreshed after a 3-month coding bootcamp in Silicon Valley).

- Implement a “9/80” work schedule: 9-hour days with every other Friday off. Hello, long weekends!

3. Feedback Loop Frenzy

Create a feedback culture that’s more addictive than reconciling a tricky account:

- Use pulse surveys for real-time feedback on employee satisfaction.

- Implement reverse mentoring where junior staff coach senior leaders on new tech and trends.

- Host quarterly “State of the Firm” meetings where financials and strategy are shared openly.

4. Upskilling Unleashed

Keep your team’s skills sharper than a freshly sharpened pencil:

- Offer in-house “mini-MBA” programs focused on leadership and strategy.

- Create a “Skills Marketplace” where employees can learn from each other.

- Partner with tech firms for exclusive training on emerging financial technologies.

The Bottom Line

The accounting talent crunch is real, but it’s not insurmountable. By focusing on competitive compensation, cutting-edge tech, a killer culture, and continuous growth, you can attract and retain top talent that’ll make your firm the envy of the industry.Remember, in the words of Jack Hartung, CFO of Chipotle (who’s probably crunched more numbers than there are burritos in the world): “The future accountant will be charged with contributing to the company’s strategy”3. So, let’s build a workforce that’s ready to do just that.Now, go forth and conquer the talent market like it’s a complex tax return. Your future accounting superstars are out there, waiting to balance your books and your bottom line.