Understanding your finances can seem overwhelming, but it doesn’t have to be. A sample bank statement PDF is a practical tool that can help you get a clearer picture of your financial situation. This guide will walk you through how to interpret these statements, create your own, and the importance of regularly reconciling your accounts. Plus, we’ll share tips on how to maximize your financial insights for better money management.

Key Takeaways

- A sample bank statement PDF is essential for tracking your financial transactions and identifying spending habits.

- Regularly reviewing your bank statement can help you spot errors and discrepancies, ensuring accurate financial records.

- Creating your own bank statement can simplify your financial management and help you stay organized.

Decoding Your Sample Bank Statement PDF

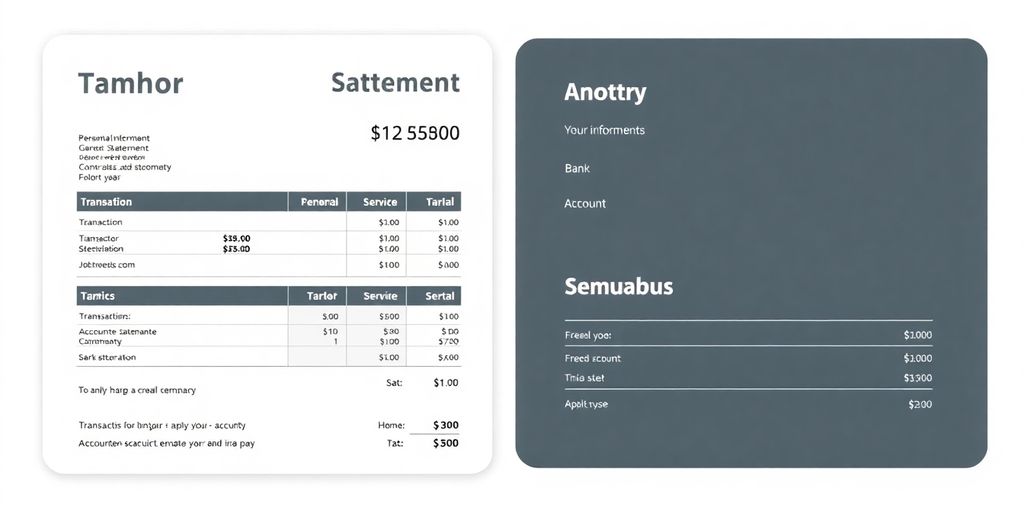

What’s Inside That PDF?

When you pop open your sample bank statement PDF, you’re facing a document that’s more than just a numbers dump. You’ve got everything from daily transactions, deposits, withdrawals, and charges neatly laid out to show how your money moved around. Each entry is a clue to your financial story, so look closely.

Here’s a quick bullet list of what you might spot:

- Daily transaction logs

- Account balance summaries

- Date-specific details

If you’re curious, check out these bank statement tips to see more on reading these details.

Understanding the Jargon

Let’s be honest, bank statements come peppered with all sorts of shorthand that might look like a foreign language. Terms like "CTR" for credit, "DBT" for debit, or even those uncommon abbreviations might leave you scratching your head. Don’t worry, it isn’t rocket science. It’s just a bunch of finance speak that breaks down the transactional lingo.

Take a peek at this simple table for a quick debrief:

| Abbreviation | Meaning |

|---|---|

| CTR | Credit Transaction |

| DBT | Debit Transaction |

| XFER | Fund Transfer |

These snippets are vital for recognizing where your money is coming in and going out. Keeping track means you’re less likely to be surprised by any hidden fees or errors.

How to Spot Errors

No one’s perfect—not even the bank’s computer. Sometimes, errors sneak into your statement. The trick is to review every line with a bit of skepticism. When something just doesn’t add up, it’s time to flag it. Here’s a mini checklist to help you catch those slip-ups:

- Compare your receipts with the entries on the statement.

- Look out for duplicate transactions or missing deposits.

- Check if all dates and amounts line up with your records.

It’s worth taking a few extra minutes each month to reconcile your statement. Catching errors early can save you a ton of hassles down the road, and help keep your finances in tip-top shape.

Remember, a well-read bank statement is your best friend when it comes to keeping your money matters under control.

Crafting Your Own Bank Statement

Creating your personal bank statement might sound like an overwhelming task, but trust me, it can be a fun (and even satisfying) process when you break it down into manageable steps. Let’s walk through it together.

Step-by-Step Guide

- Start by gathering all your financial data – bank balances, check images, receipts – everything you need to build your record.

- Sketch a layout that mirrors the look of a typical bank statement, detailing header info, transaction columns, and summary sections.

- Input your transactions chronologically. Don’t skip any transaction details; even small charges matter.

- Once you’re done, give your statement a review to check for accuracy. A quick tip: compare it with your official statements if available.

For those wanting a smoother process, you might find using some handy tools like quick downloads a real game-changer.

Essential Elements to Include

Make sure your bank statement covers these key areas:

- Account Information: Your name, account number, and bank’s contact info

- Transaction Details: Dates, descriptions, and amounts for every deposit and withdrawal

- Summary Section: A quick breakdown at the end showing the total credits, debits, and final balance

Here’s a small table to visualize the layout elements you should consider:

| Section | Details |

|---|---|

| Header | Bank name, date, account details |

| Transaction List | Date, description, amount |

| Footer Summary | Total deposits, withdrawals, balance |

Including all these parts makes your statement clear and helps in spotting any irregularities later.

Common Mistakes to Avoid

While it’s easy to get caught up in details, here are a few pitfalls you should steer clear of:

- Rushing through your entries – double-check every transaction to prevent errors.

- Forgetting minor transactions – even small fees add up over time!

- Overcomplicating the layout – keep it simple, clear, and straightforward

When you nail down the basics, you’re halfway to financial freedom.

Taking the time to craft an accurate personal bank statement not only gives you better financial clarity but also builds a good habit of keeping records straight. Enjoy the process, and remember, every bit of effort now saves you a lot of stress later.

The Importance of Regular Reconciliation

When you skip your bank statement reviews, you might as well be letting a sneaky ninja rob you while you’re not looking. Regular reconciliations keep your money matters in check, and more importantly, they signal that you’re serious about financial health. Let’s break it down further.

Why Reconcile?

You might wonder, why even bother with reconciliation? Well, here are a few reasons to get off the couch and check your statements:

- It helps you catch errors before they turn into big headaches.

- You can spot unauthorized charges right away, saving you from unexpected surprises.

- Regular reviews keep your cash flow clear so you always know what’s coming in and what’s going out.

Think of it as keeping your financial diary up to date – a little check now avoids a big mess later.

How to Reconcile Like a Pro

Alright, let’s get into the nuts and bolts of doing it right. Follow these simple steps to keep everything straight:

- Match every entry: Go through each transaction and compare it with your own records. This way, no sneaky charge goes unnoticed.

- Double-check with your receipts and bank notifications. If something doesn’t add up, investigate immediately.

- Schedule a regular check-in. Whether it’s weekly or monthly, putting it on your calendar ensures you don’t forget.

Regular reconciliation is your safeguard against financial mayhem! It might seem like a hassle now, but trust me, you’ll feel more in control sooner than you think.

Tools to Simplify the Process

Embracing technology can really lighten your load. Here are a few tools you might consider to make reconciliation quickly and efficiently:

| Tool Name | Purpose | Note |

|---|---|---|

| Accounting Software | Syncs transactions automatically | Ideal for busy schedules |

| Digital Ledger | Records transactions in real time | Keeps your data updated instantly |

| Mobile Banking App | Quick transaction views | Perfect for on-the-go checks |

Using the right tools can turn a once-dreaded task into a manageable routine. The key is to start small and build a habit that works for your lifestyle.

By integrating these practices, you’re not just balancing numbers—you’re taking charge of your money. So, roll up your sleeves and get ready to make reconciliation a regular part of your routine!

Maximizing Your Financial Insights

When you take a closer look at your finances, you’re not just staring at numbers—you’re uncovering clues about where your money is sneaking off to. With a good dose of curiosity and a little help from modern tools like smart bookkeeping, you can actually use your bank data to guide your financial freedom.

Analyzing Spending Patterns

Start by reviewing where your money flows each month. Look at your daily, weekly, and monthly expenses to get a handle on any wild spending habits. It might seem tedious, but spotting trends early can save you a lot of trouble down the road. Here’s a quick list to get you started:

- Track everyday purchases to identify recurring costs.

- Compare expense categories over time.

- Look for unexpected spikes that could indicate an error or a one-time splurge.

Sometimes it helps to see your data visually. Try using a simple table to record your monthly expenses:

| Expense Category | January | February | March |

|---|---|---|---|

| Groceries | $250 | $240 | $260 |

| Utilities | $120 | $130 | $125 |

| Entertainment | $80 | $95 | $90 |

This can give you a bird’s-eye view of your spending trends over the course of a few months.

Setting Financial Goals

Now that you see the big picture, set some targets. Without knowing where your money goes, it’s hard to decide what to cut back on or how much to save. Setting clear goals helps you cement a plan that feels both realistic and inspiring. You might want to aim for:

- Saving a certain percentage of your income.

- Reducing impulse buys by a set dollar amount.

- Investing in a new hobby or skill that can boost your earnings.

Choosing goals can make every spending decision feel more intentional. Jot them down somewhere you can check them off as you hit your milestones.

Using Templates for Better Tracking

Templates aren’t just a boring office tool—they can be lifesavers if you’re not into reinventing the wheel every month. Whether you use a spreadsheet or download a ready-to-go template, these tools can get you organized fast. Pick a template that suits your style and stick with it. A good template will usually include sections for income, fixed expenses, and variable spending. Here’s a simple breakdown you might expect:

- Income Tracker

- Expense Breakdown

- Savings and Investments Log

If you’re feeling adventurous, customize the template to fit your personal finance style. Use colors to mark urgent figures, add notes for recurring expenses, or even build a mini dashboard to quickly see your progress.

Remember: keeping an eye on your money isn’t about being stingy. It’s about knowing what you have so you can plan for what you really want.

Wrapping It Up: Your Financial Journey Starts Here

So there you have it! Understanding your bank statement isn’t just about numbers; it’s about taking charge of your financial life. Think of it as your personal financial GPS, guiding you through the twists and turns of your spending habits. Sure, it might feel a bit overwhelming at first—like trying to assemble IKEA furniture without the instructions. But once you get the hang of it, you’ll be cruising smoothly. Remember, keeping tabs on your finances can save you from those "uh-oh" moments when bills come knocking. So grab that bank statement, give it a good look, and start making those savvy financial moves. You’ve got this!

Frequently Asked Questions

What is a bank statement?

A bank statement is a document from your bank that shows all the transactions in your account over a certain time, like deposits and withdrawals.

How can I use a bank statement template?

You can use a bank statement template to keep track of your money. It helps you see where your money is going and helps you plan your budget.

How often should I check my bank statement?

You should check your bank statement at least once a month to stay on top of your finances and spot any mistakes.